The next Bitcoin halving, an event that significantly impacts the number of new bitcoins entering circulation, is projected to occur in April 2024. This will mark the fourth halving in the history of Bitcoin and is anticipated to reduce the mining reward from the current 6.25 bitcoins per block to 3.125 bitcoins per block.

What is Bitcoin Halving?

Bitcoin halving refers to the scheduled reduction in the reward that miners receive for adding new blocks to the Bitcoin blockchain. This event occurs roughly every four years, or after every 210,000 blocks are mined. It’s a core mechanism of Bitcoin that ensures no more than 21 million bitcoins will ever exist, adhering to its design as a deflationary currency.

The concept stems from Bitcoin’s aim to be a counterpoint to traditional fiat currencies, which can be printed without limit and thus are susceptible to inflation. By decreasing the reward for mining activities, Bitcoin systematically reduces the rate at which new coins are created, thereby controlling inflation and enhancing its scarcity.

Historical Perspective and Impact on Bitcoin’s Price

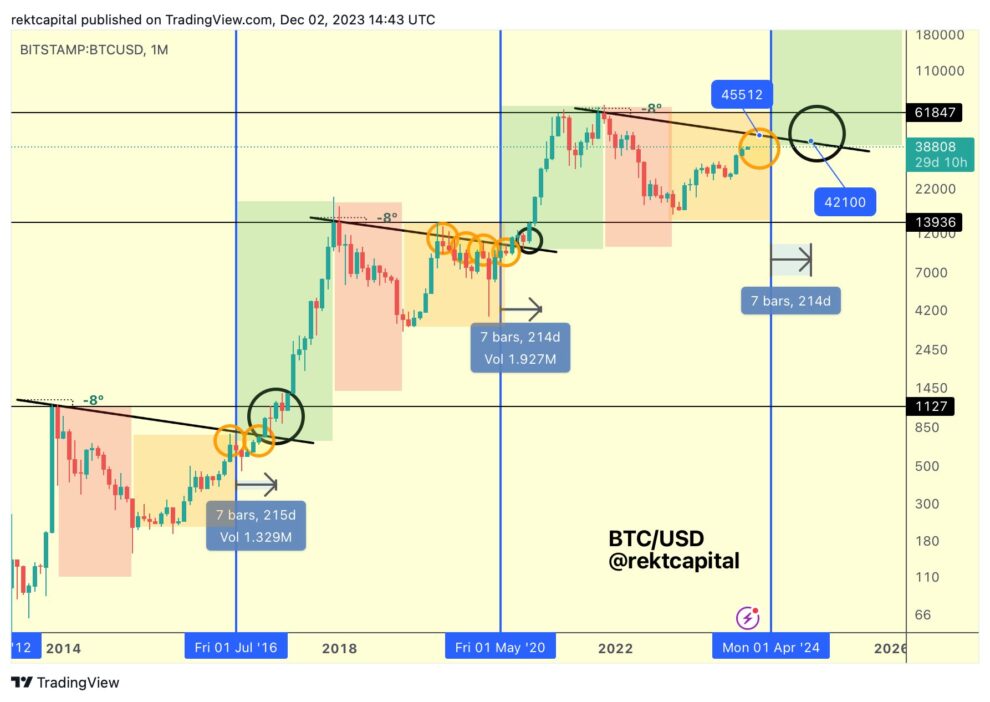

Each of the past halvings has significantly influenced the Bitcoin market and broader cryptocurrency landscape. The first halving in 2012 cut the reward from 50 to 25 bitcoins per block, and each subsequent halving further reduced this reward. Historical data suggests that each halving event has led to a bullish period in the months following the adjustment, although it is essential to note that numerous factors can affect market prices and past performance is not necessarily indicative of future results.

Miners and the Halving

Miners play a crucial role in the Bitcoin ecosystem by securing the network and processing transactions. Halving impacts miners by reducing their earnings from rewards, potentially pushing out less efficient miners due to decreased profitability. However, the reduction in new coin supply can also lead to increased Bitcoin prices, which can offset the reduced reward quantity.

Long-term Implications

Looking towards the future, as the reward decreases over time, transaction fees are expected to become a more significant part of miners’ rewards. This shift is crucial as it could affect transaction costs and network security. The ultimate mining reward will taper down to zero by around 2140, at which point all 21 million bitcoins will have been mined. From then on, miners will rely entirely on transaction fees for compensation.

Final Thoughts

As we approach the 2024 halving, the Bitcoin community and potential investors are watching closely to see how reduced block rewards will affect the dynamics of supply and demand. While the exact outcomes of this halving are uncertain, the event undeniably represents a critical moment for Bitcoin, emphasizing its unique economic model contrasted with traditional monetary systems.